While living in the heart of a big city may have once been a dream, COVID-19 has flipped the switch on American’s desire to live in urban areas.

The biggest metros in the United States are at the mercy of the need for personal space, with several establishing rescue plans to maintain the cities population. Fear-stricken residents are raising a brow at their current close-quarters living situation and beginning to explore smaller towns with a lower threat of contracting the virus.

Unlike most years, 2020 is displaying a decline in metro mobility as Americans are putting their urban homes on the market and searching for ways to get out of town.

In an effort to ease city-dwellers minds, many began looking for ways to limit their contact with others and feel comfortable with where they lived. Fleeing these densely populated cities was a reasonable and realistic choice in Americans’ minds as remote working conditions and virtual hangouts became the new norm.

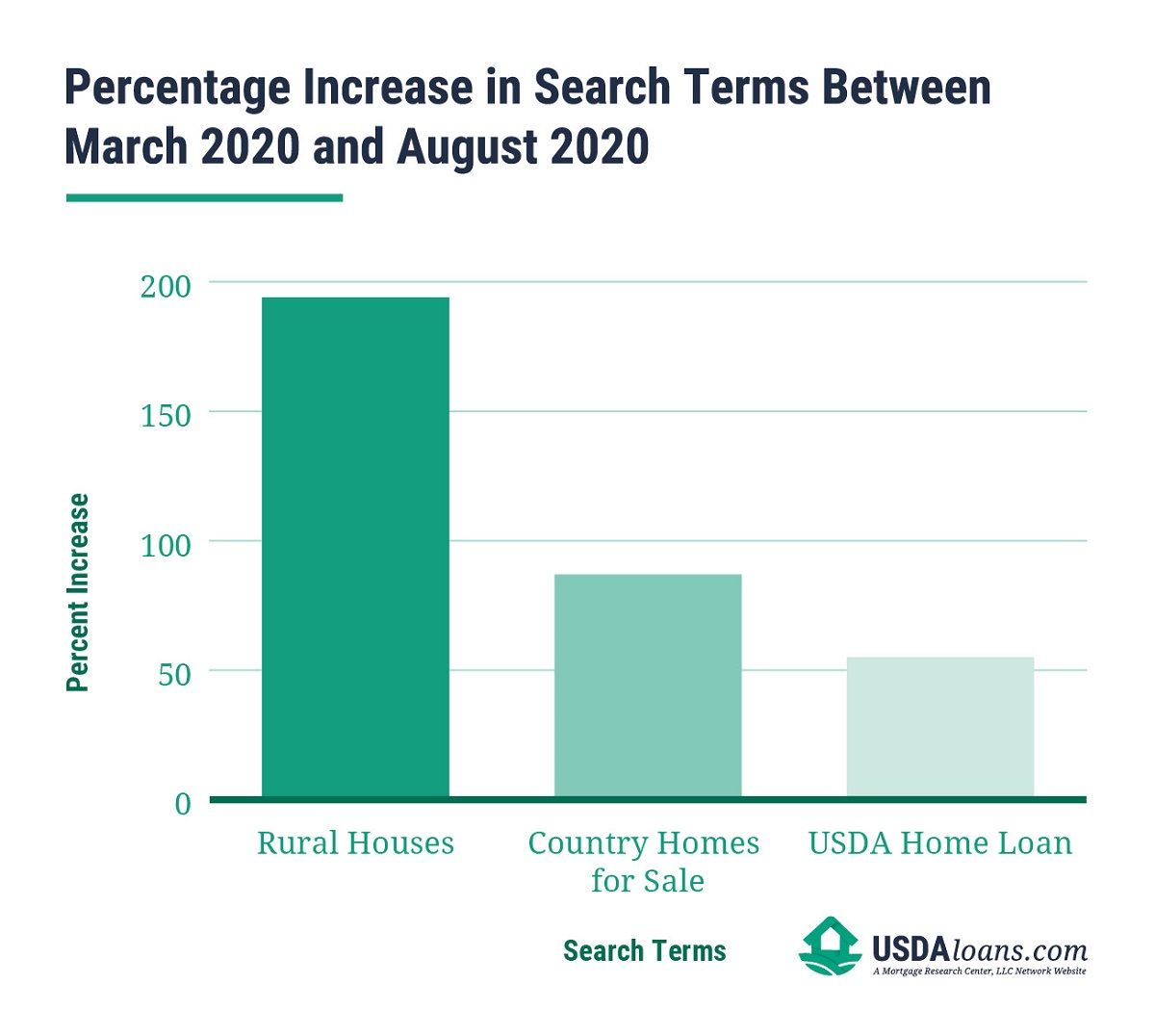

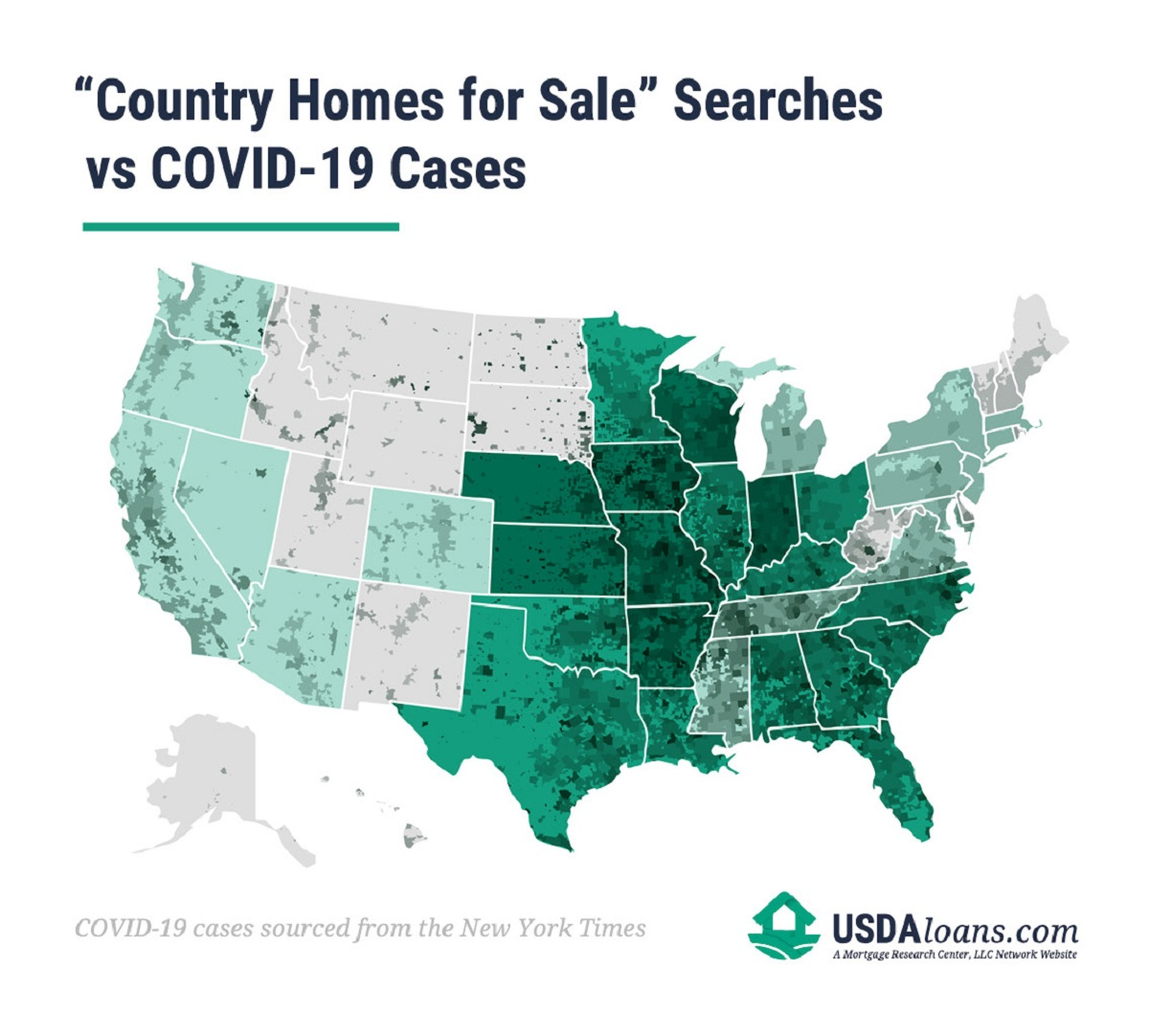

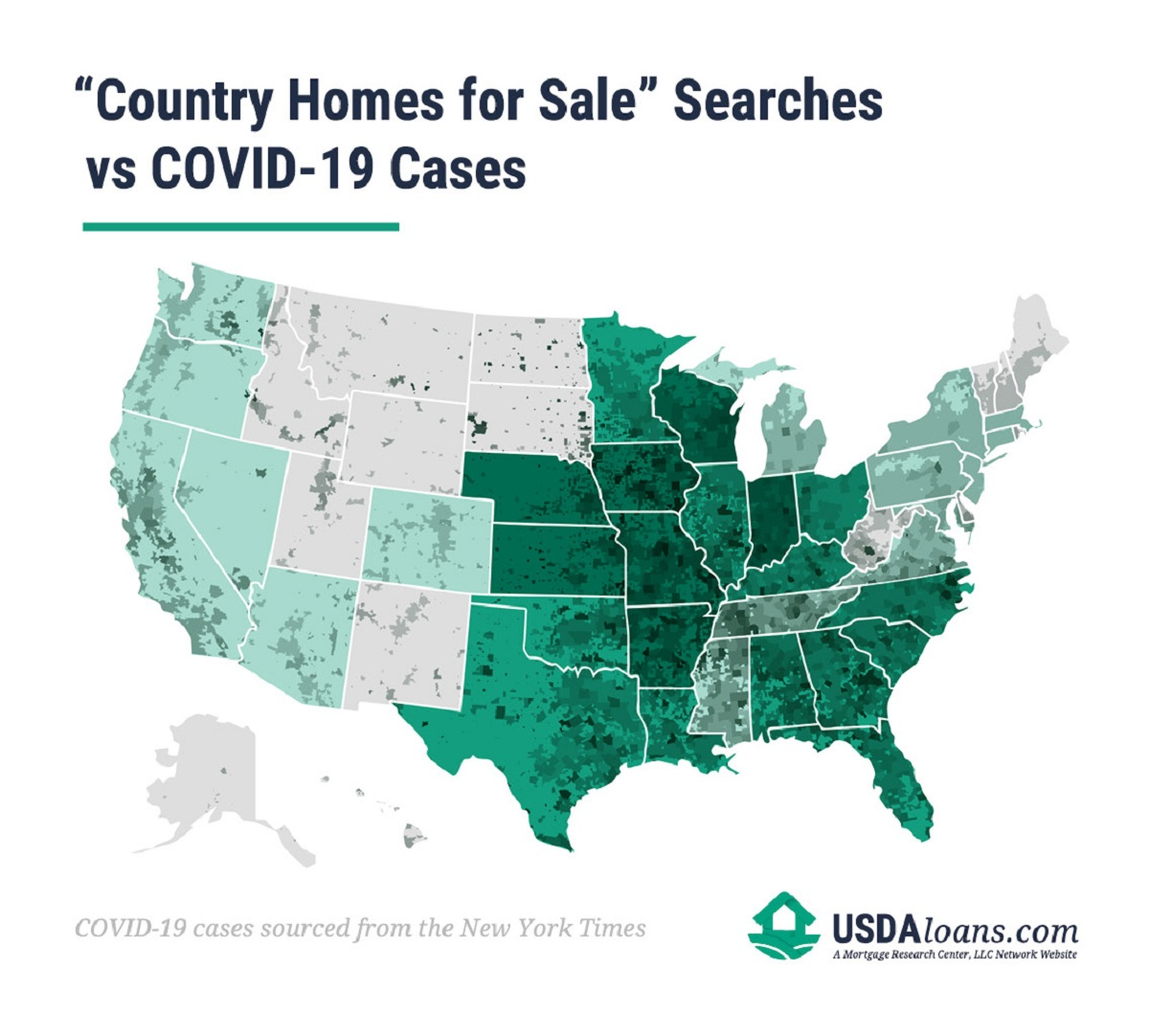

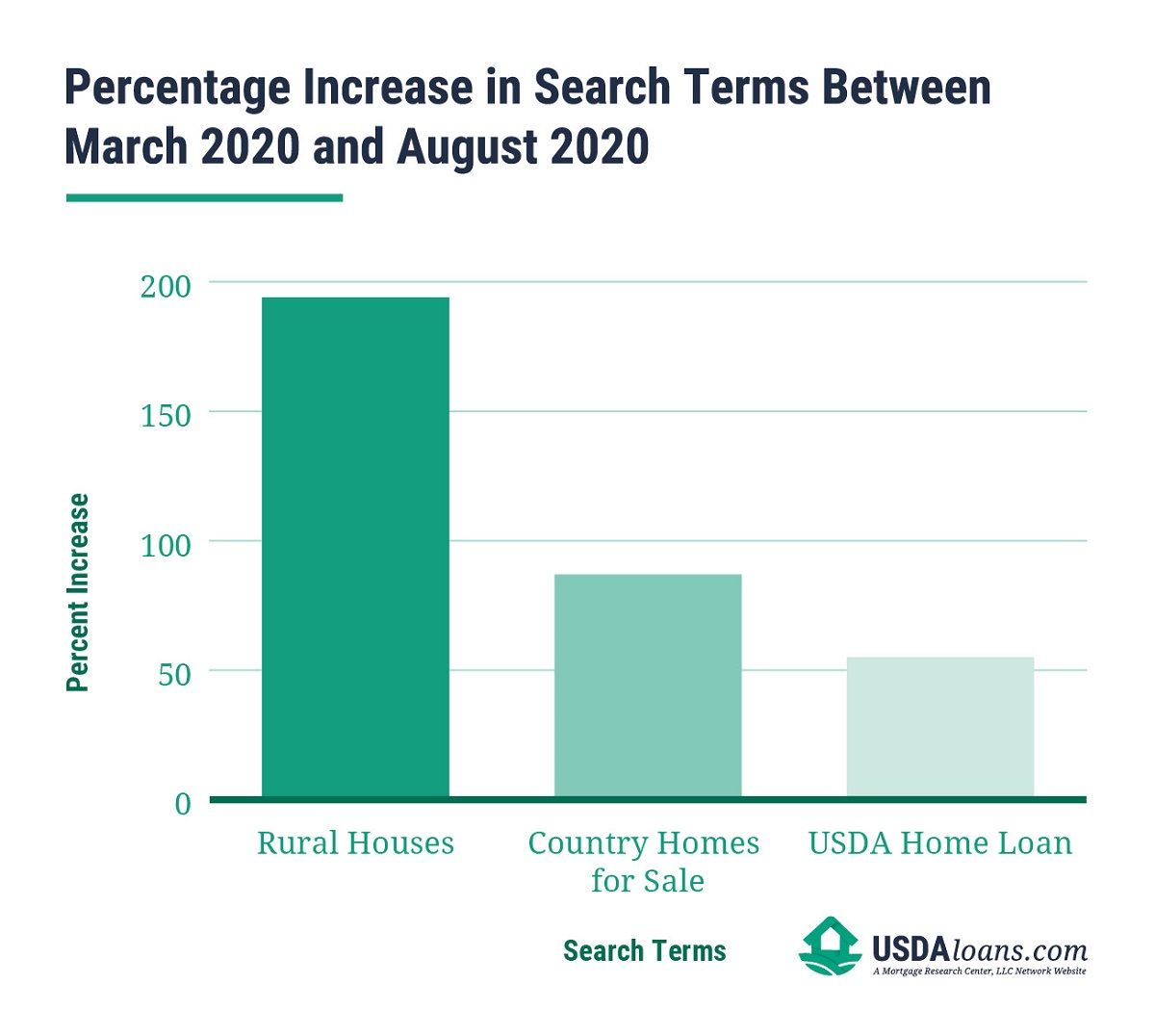

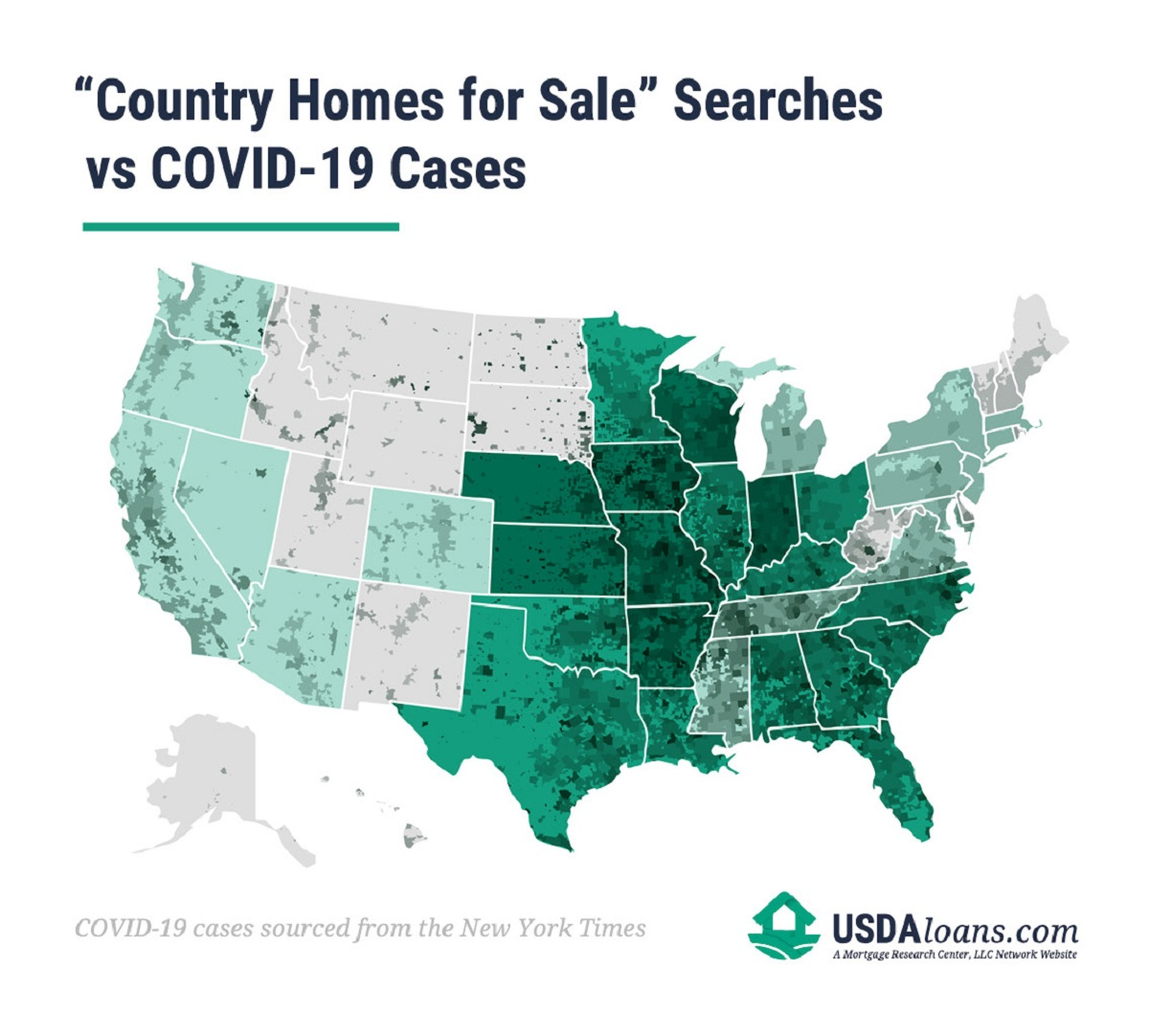

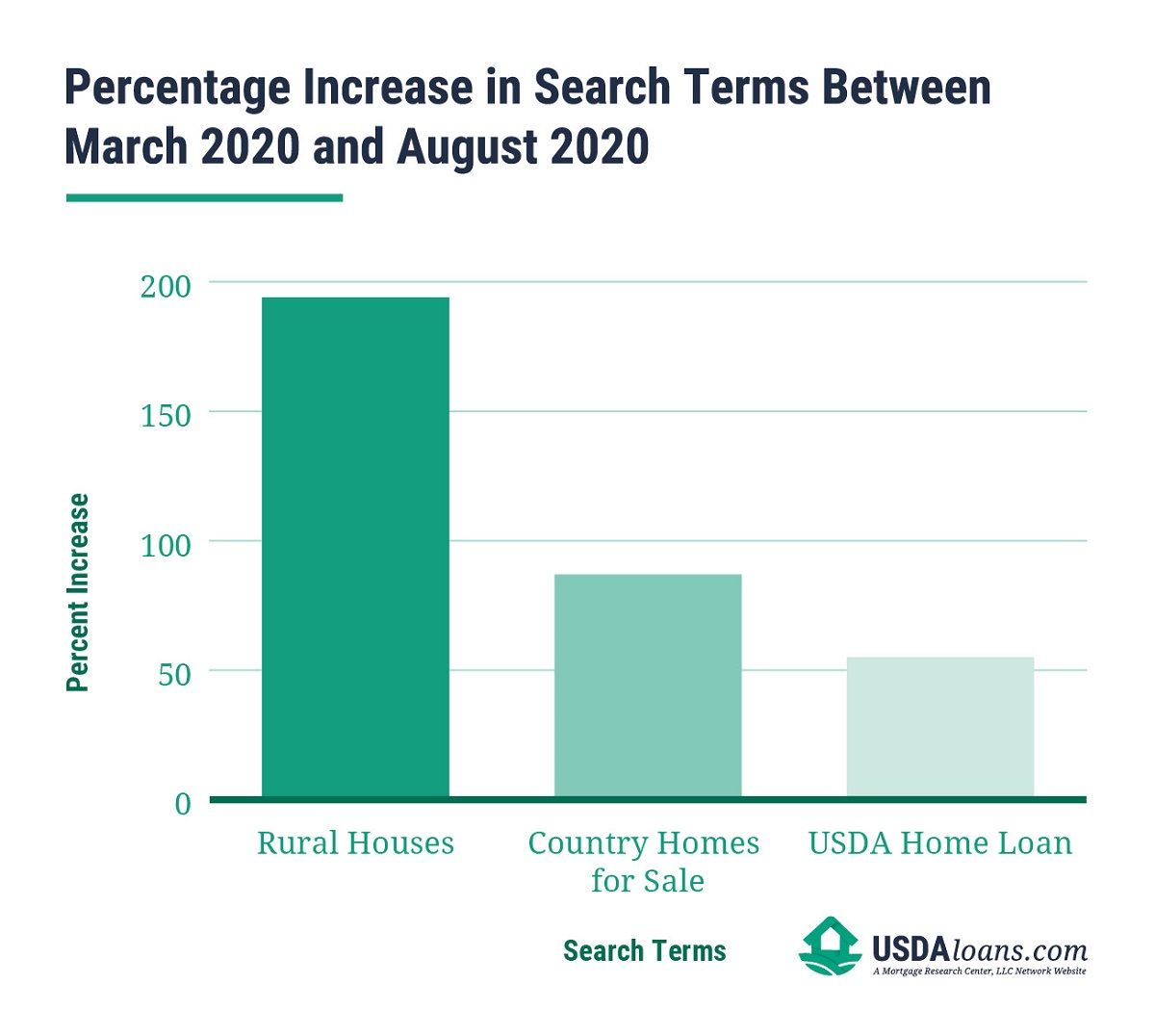

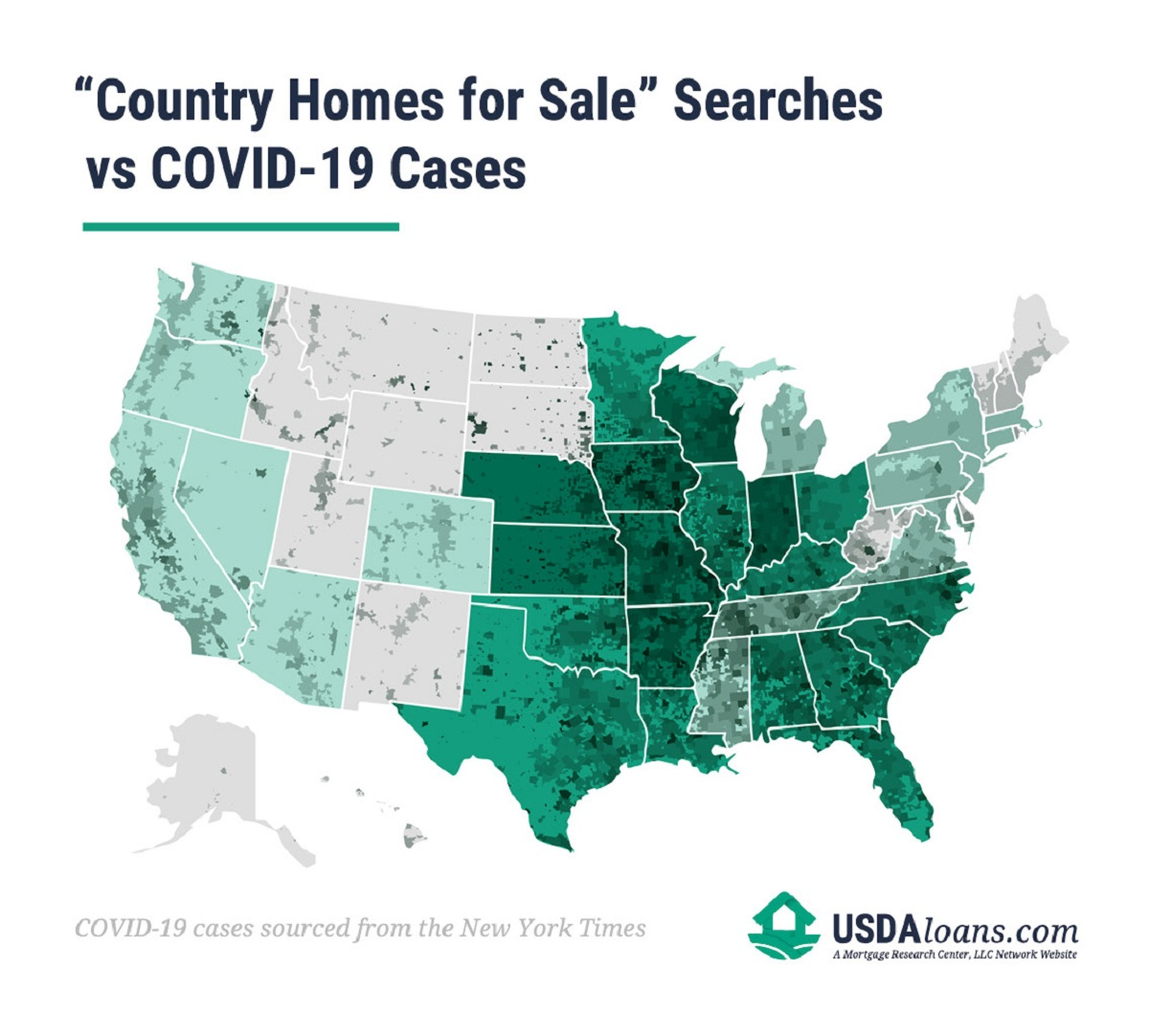

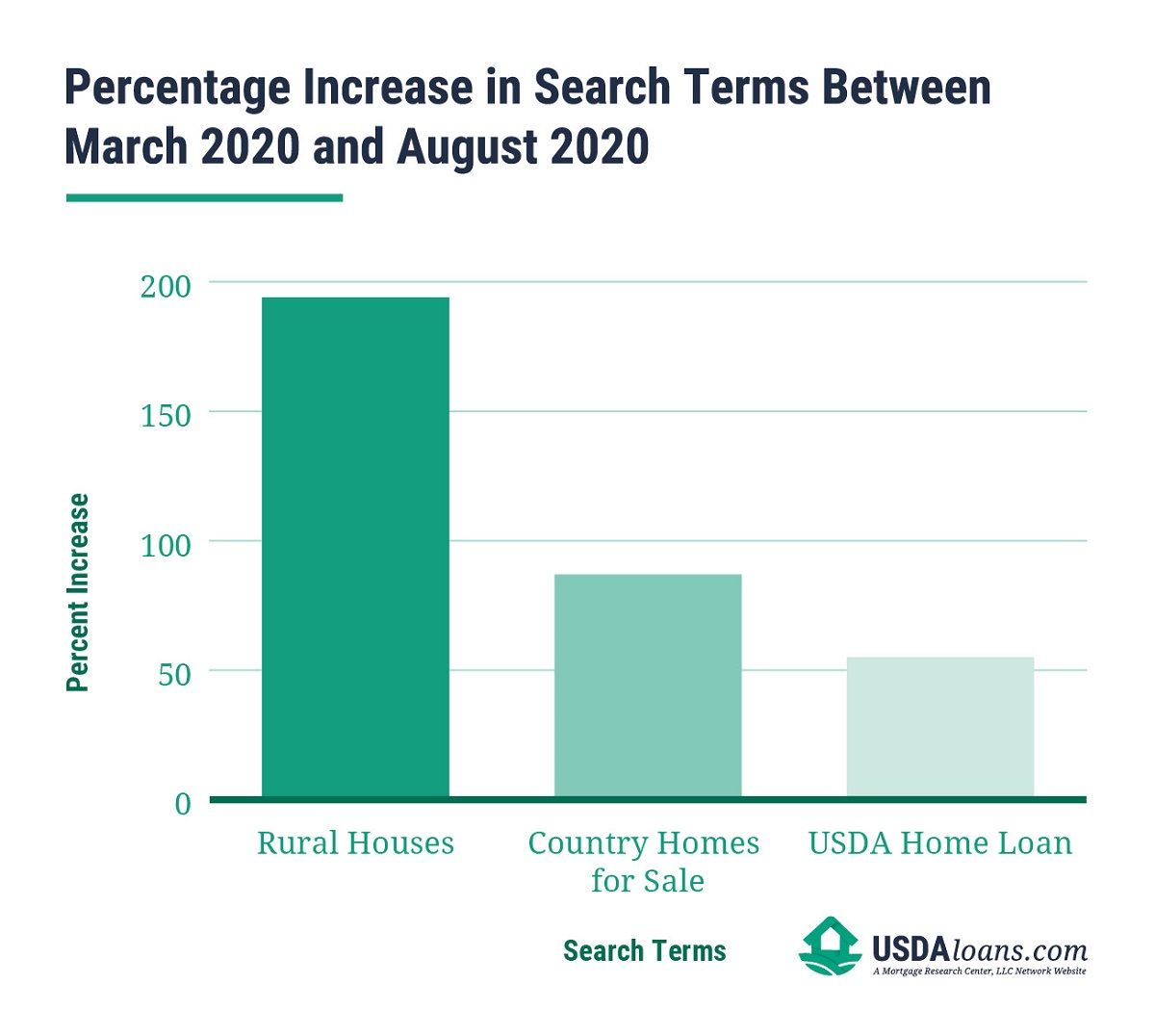

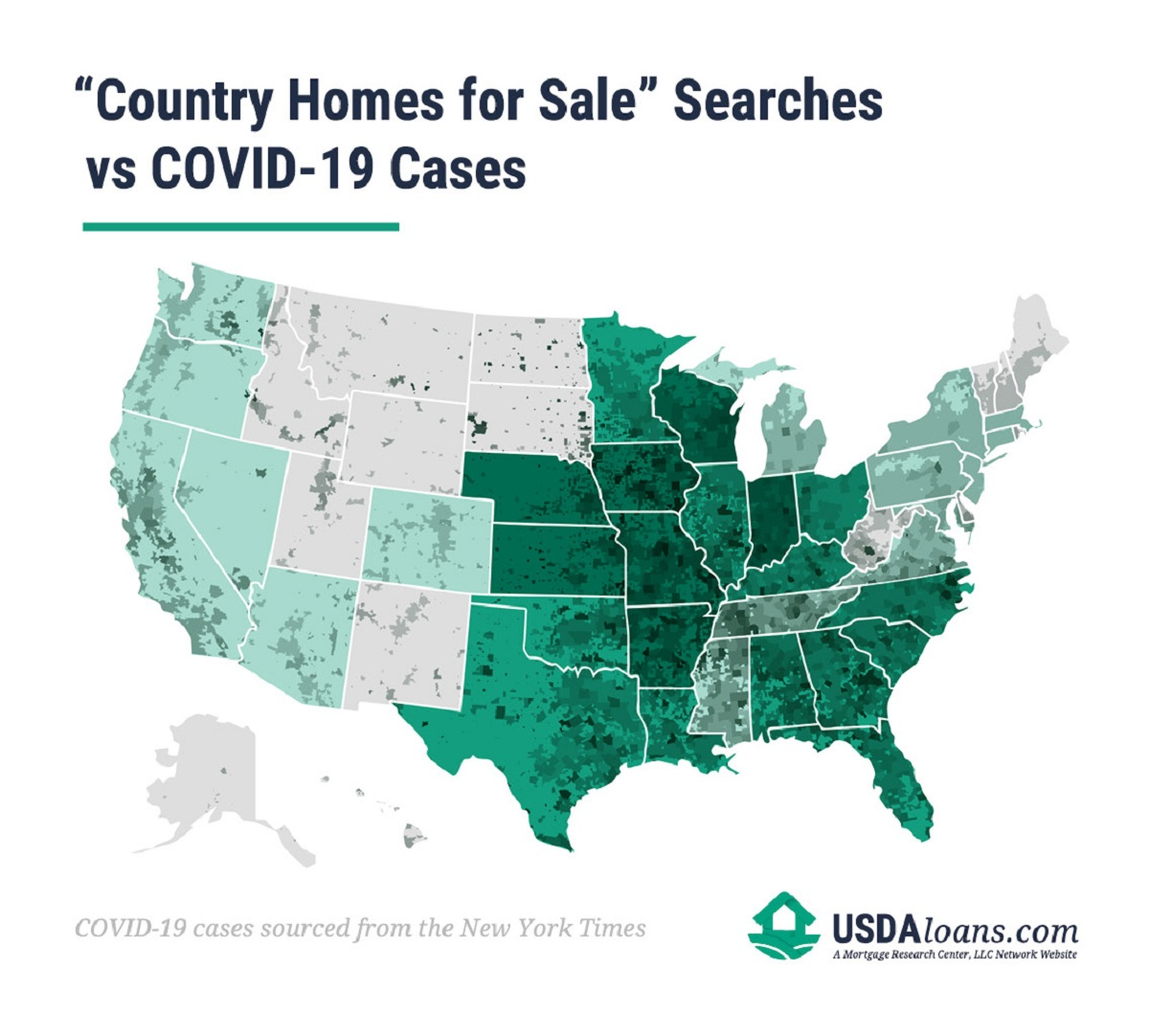

During the peak of stay-at-home orders, urban residents began searching for terms like “country homes for sale,” “rural houses,” and “USDA home loan.” In states and metros with a high number of COVID-19 cases, there is a heavy concentration of people researching more rural areas. People are actively seeking ways to escape the virus.

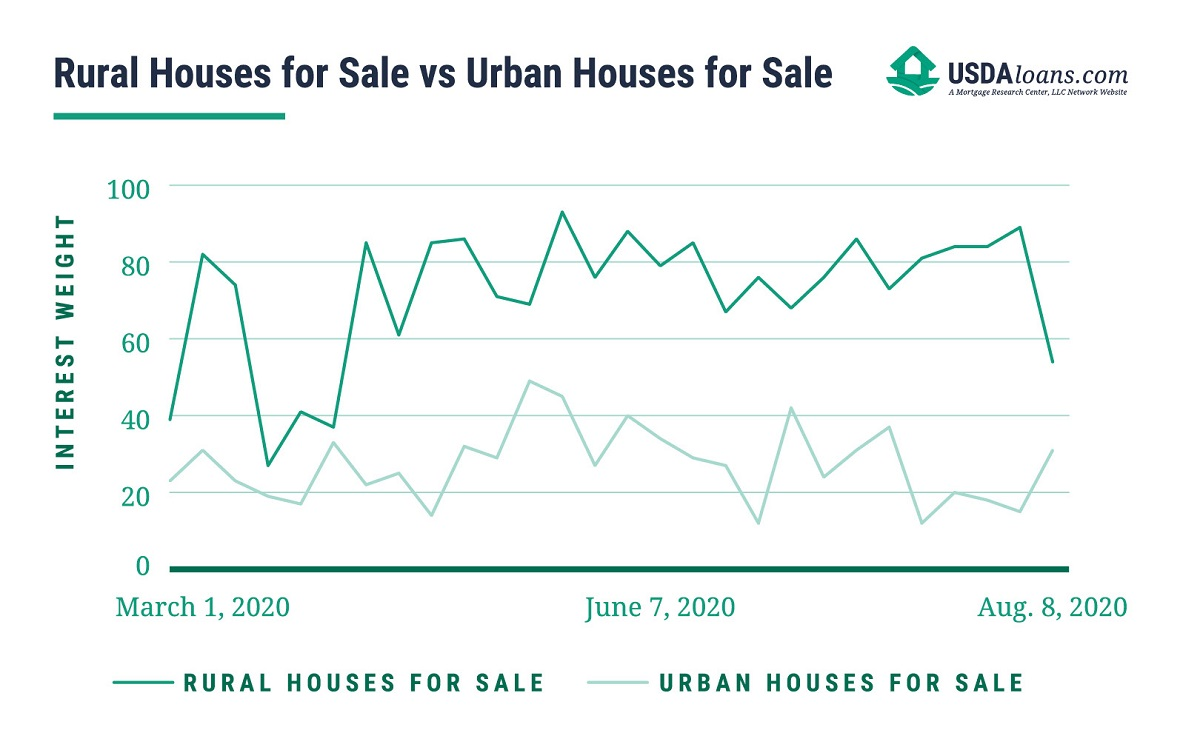

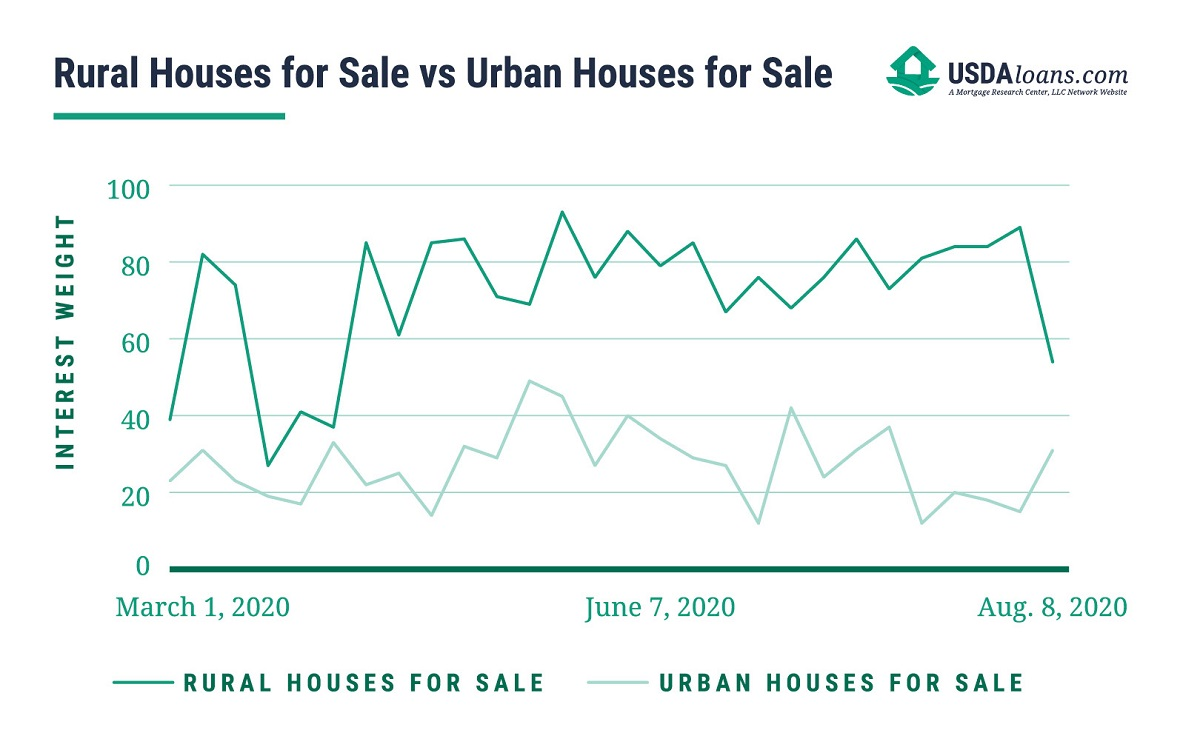

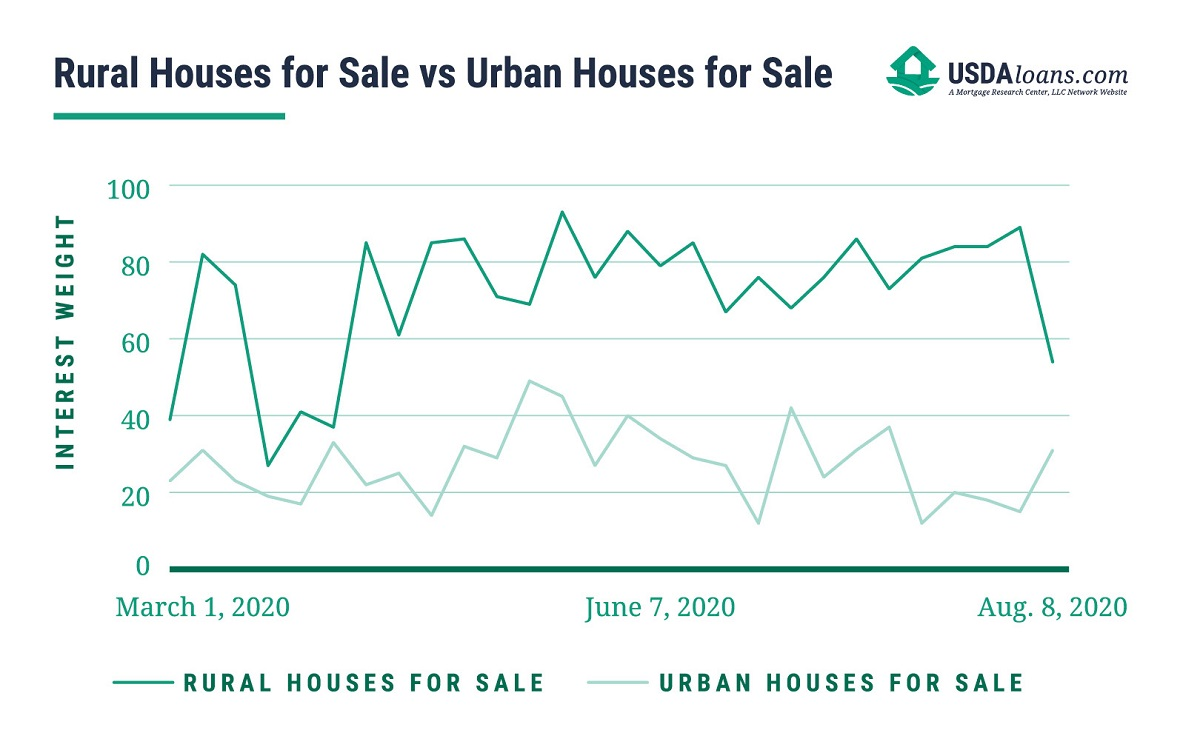

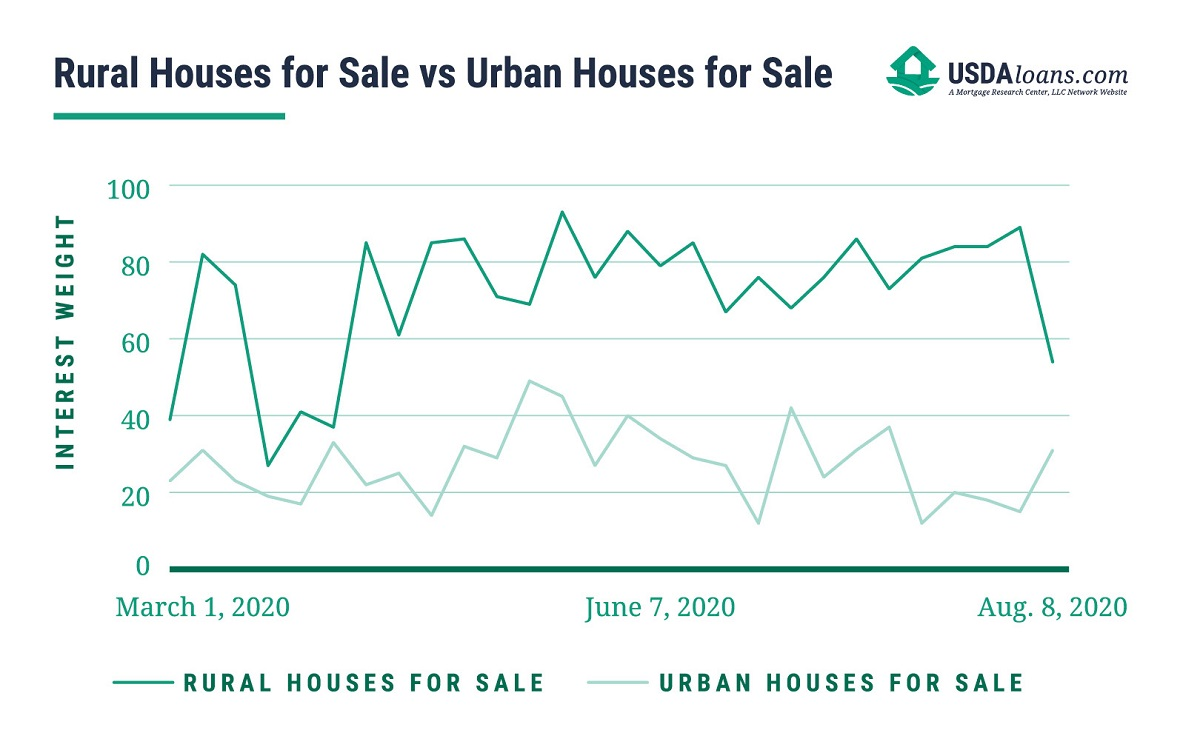

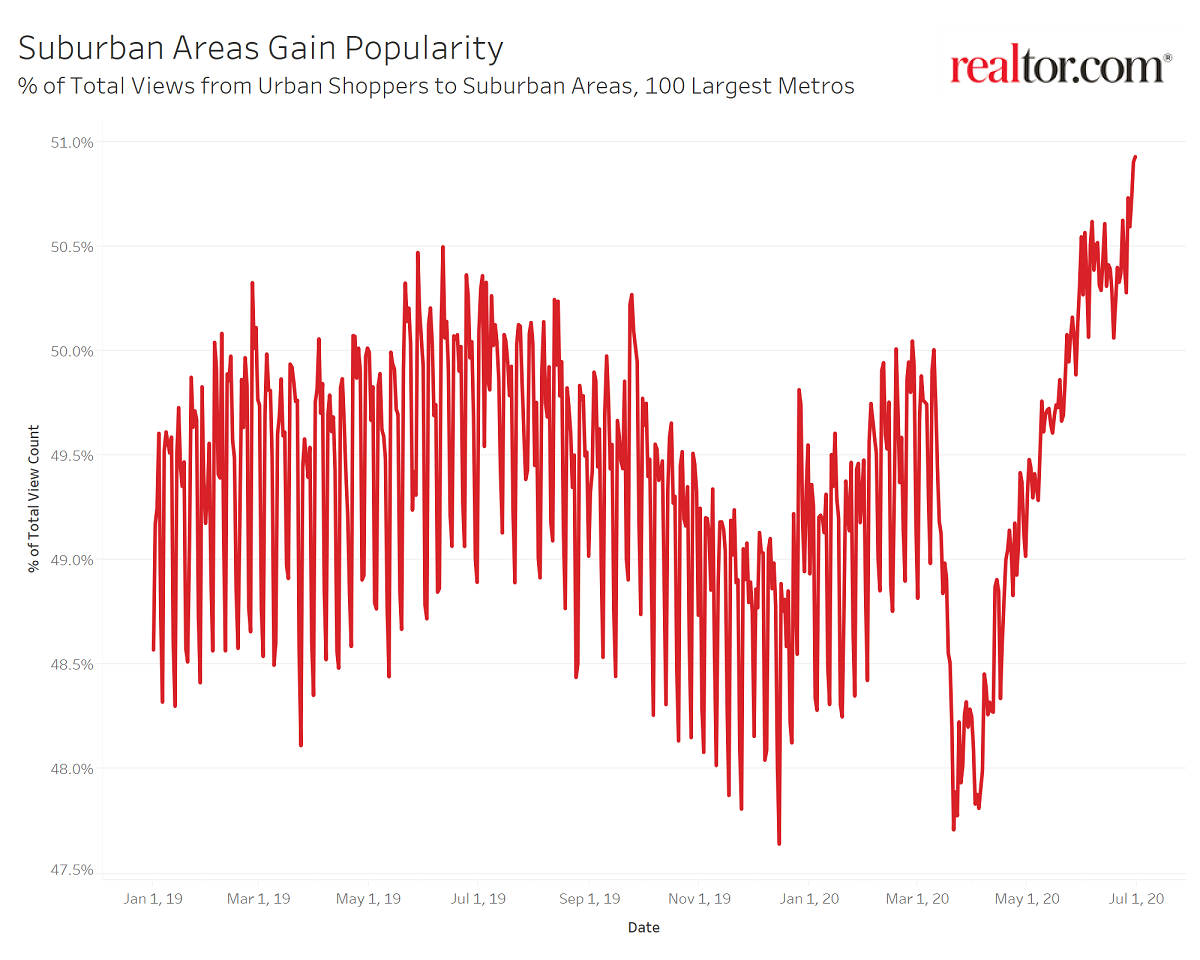

To put this in perspective, the graph below shows the juxtaposition of people searching for urban homes compared to rural ones. There is a significantly lower demand for houses in urban areas, especially in the months during statewide lockdowns.

The urbanization of America is partaking in a significant downfall. The pandemic hasn’t just created an interest in moving away from densely populated areas; it resulted in a massive change in the real estate market.

With the CARES Act passing in late March, case numbers climbing at an alarming rate, and some states beginning to reopen, Americans decided to put their money where their mouth is and take action on their desire to get out of these coronavirus hotspots.

"The ability to work remotely is expanding home shoppers' geographic options and driving their motivation to buy, even if it means a longer commute, at least in the short term," said realtor.com® Senior Economist George Ratiu.

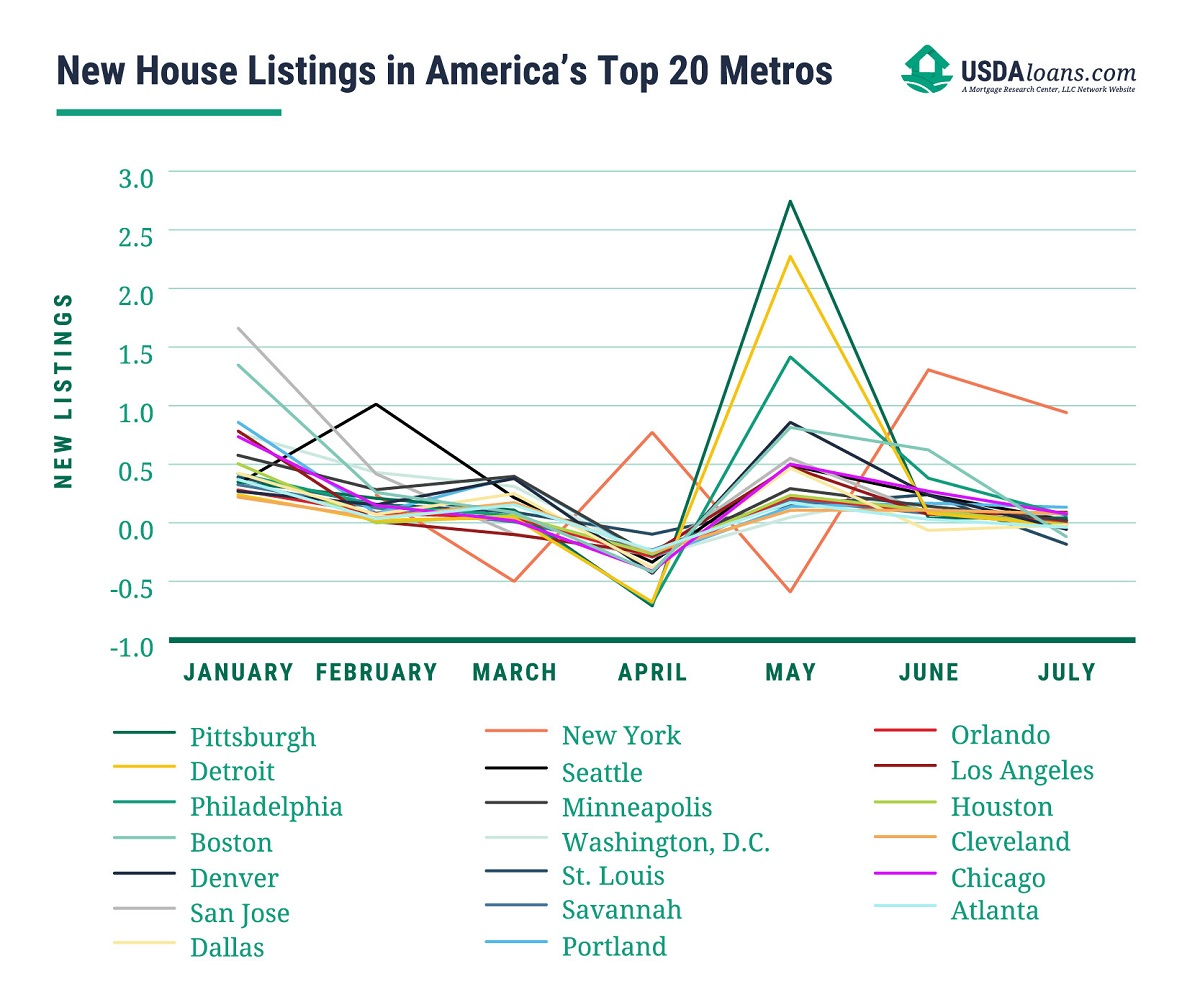

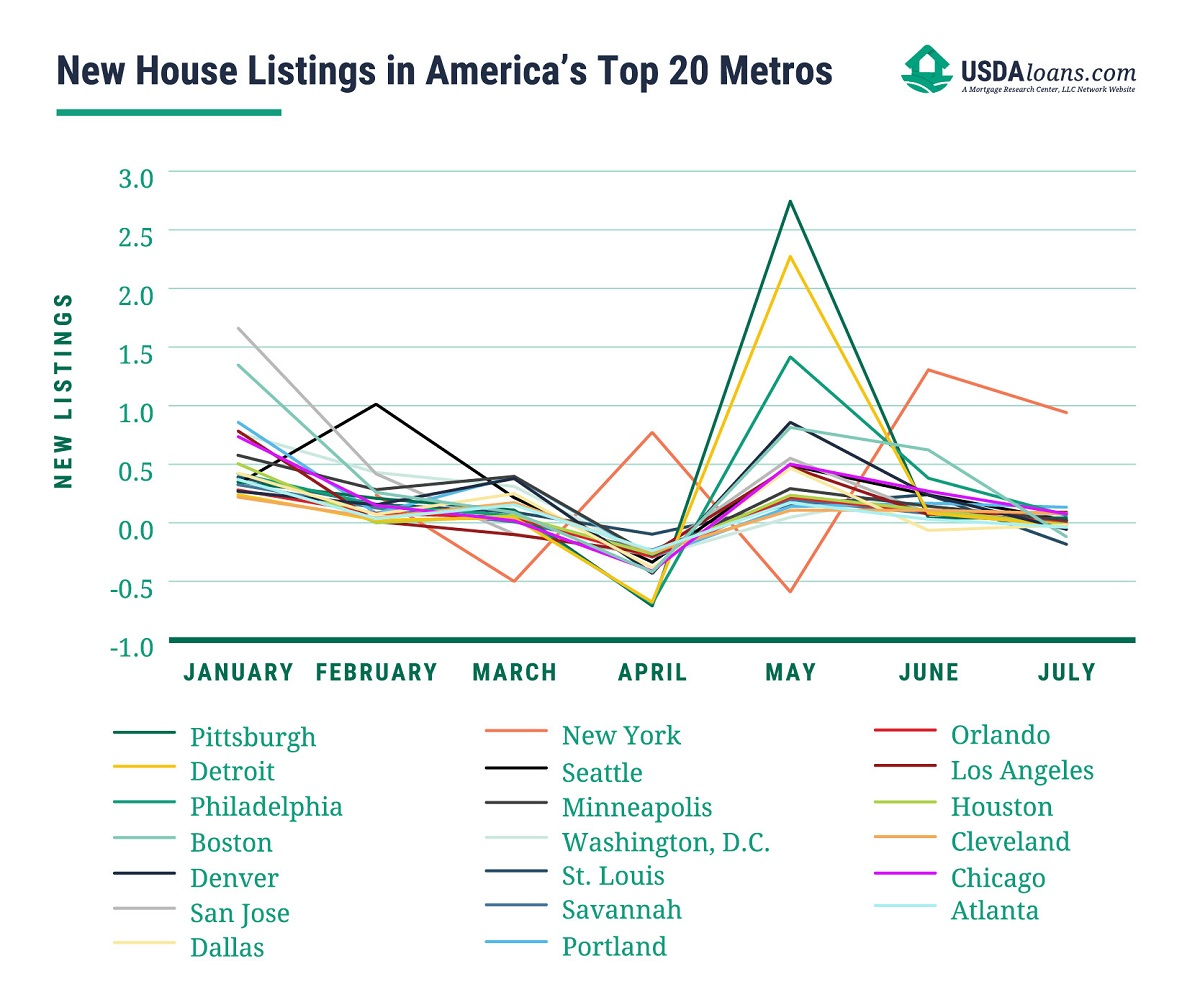

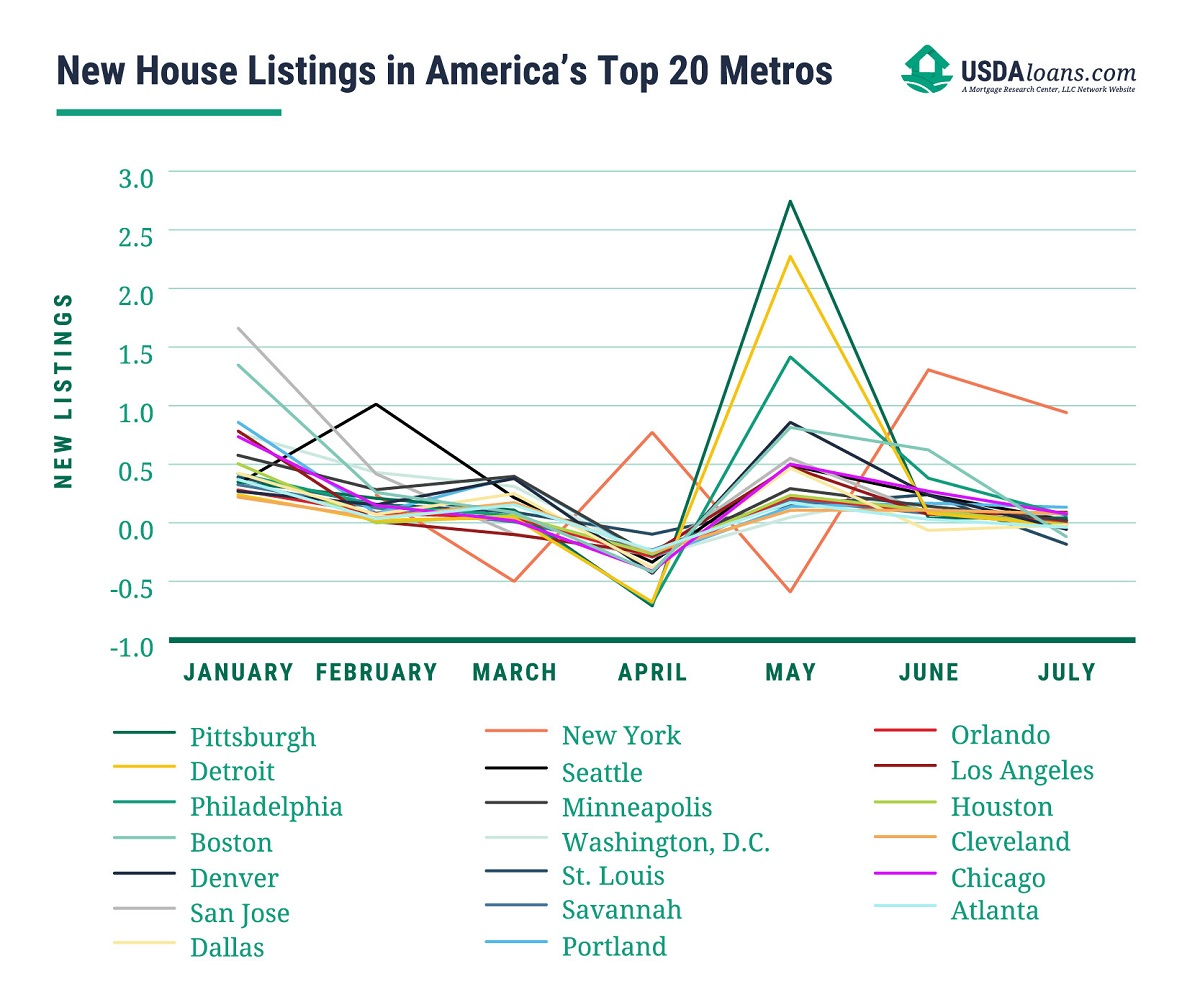

Out of the top 20 largest metros in the United States, all but one, New York City, saw an impressive spike in the number of new houses put on the market in May compared to the months before. This isn’t to say that New York City isn’t experiencing a similar trend; however, Manhattan too saw a plunge in apartment sales.

You’ll observe a large peak in new listings for each big city between April and May, which lines up almost seamlessly with the COVID-19 timeline. As soon as Americans had the opportunity to get out of the metro areas, they jumped at the chance.

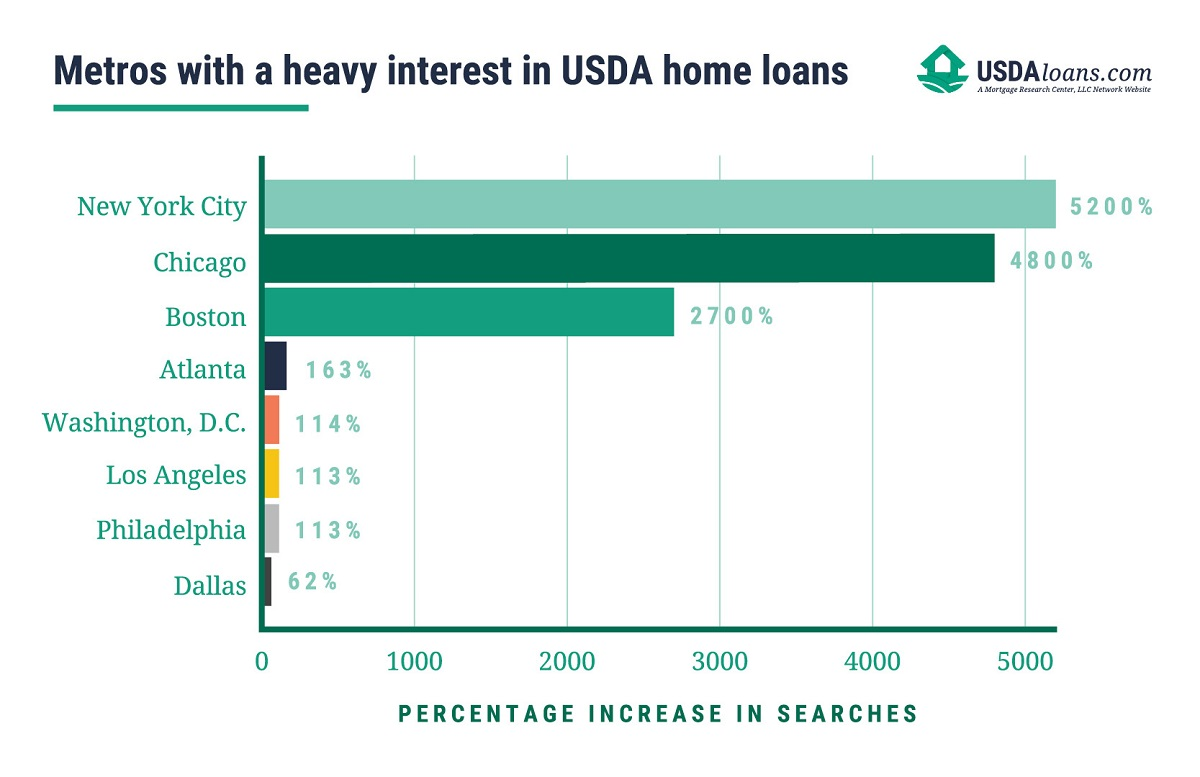

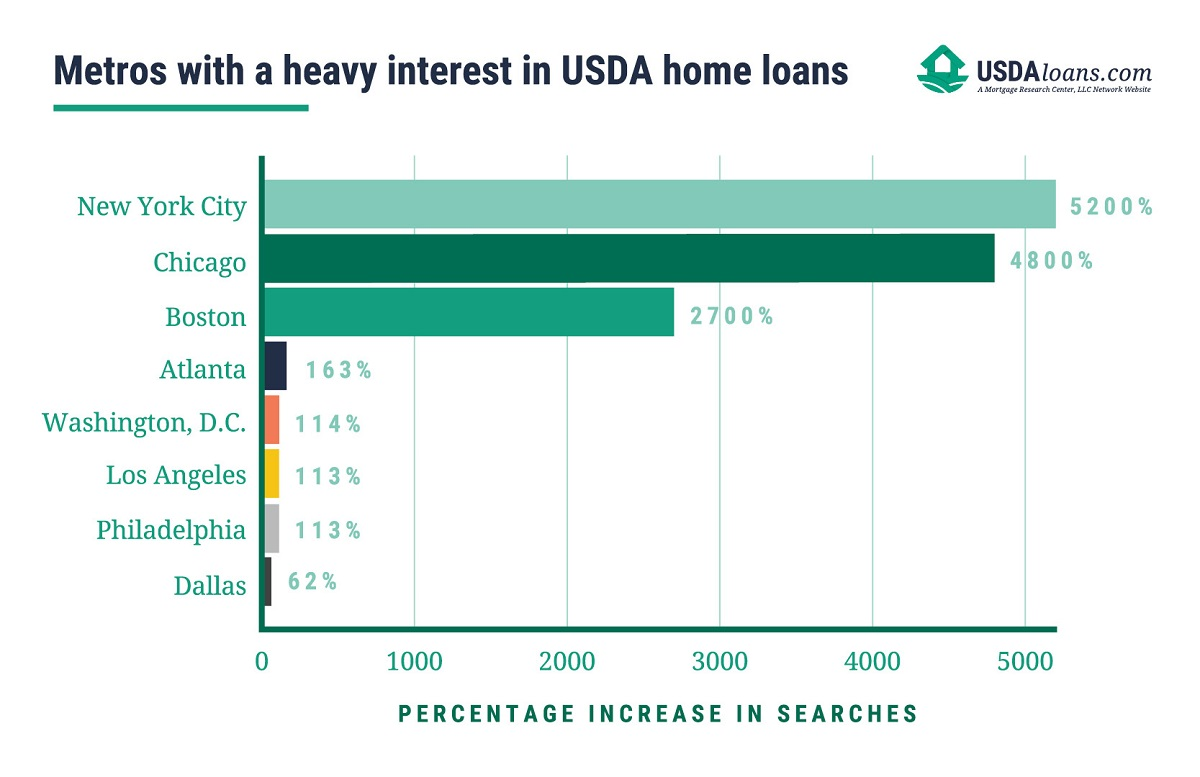

COVID-19 has created rocky financial situations for many Americans, and finding the right mortgage option can be difficult during a global pandemic. One mortgage option is gaining more traction in the past few months: the USDA home loan.

Even though only 2.2% of Americans utilized the program last year, this may not be the case for 2020. Increases in searches for the term “USDA Home Loan” have increased among the top 10 largest metros, which are also COVID-19 hotspots.

The USDA home loan has benefits many Americans should be taking advantage of, especially given the current climate:

With the second wave of COVID-19 cases coming upon the United States, interest in moving to Suburban areas is continuing to gain momentum exponentially.

Suburban areas began their appeal at an accelerated rate in late March of 2020, which is right around the time the World Health Organization declared COVID-19 a global pandemic. Still, only time will tell if this will be a lasting trend or if American will return to its old urbanization ways.